TRADEHOLD ADAPTED WELL TO CHANGED ENVIRONMENT

An agile mindset and a resourceful response to the constraints imposed by the pandemic meant Tradehold could end the 12 months to February 2021, in remarkably resilient shape, believes Friedrich Esterhuyse, its joint group CEO.

Although the group reported a net loss of £39.7m,7m, £44.5m of this was due to non-cash investment property devaluations resulting from the Covid-19 pandemic, of which £33m relates to its United Kingdom properties. A further non-cash loss of £10.7m was incurred as a result of the partial restructuring of the debt of Collins Group. This has contributed to a reduction in interest costs from an average of 11.3% to 8.4% and resulted in a saving of about R80m a year, with 75% of total debt still fixed.

This loss, he explains, does not reflect the substantial success Tradehold’s subsidiaries were able to achieve in countering and adapting to a dramatically changed business environment accelerated by Covid-19.

Tradehold ended the year with an improved cash position of £25.4m and declared a final dividend of 30c per ordinary share (60c in total for the year.

The South African business, Collins Group, not only exceeded its pre-pandemic budget income but reported a net operating profit before tax and once-off items of R297m.

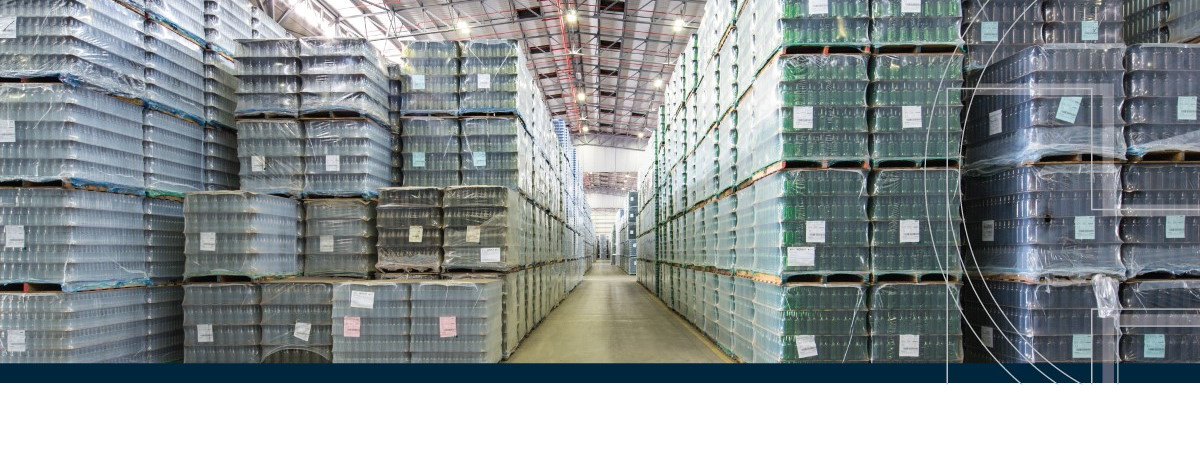

It collected 97% of all rent due (including remissions of R30m) while managing to limit vacancies to just 2,3%. Its portfolio is dominated by large industrial and distribution centres with the weighted average expiry date of contracts maintained at 6.5 years.

Collins is in the fortunate position that 78% of its revenue is derived from large national and/or listed companies.

Just before the end of the reporting period Collins concluded its first acquisition outside Africa. It bought six retail warehouse properties in Austria for €33.2m, all six of which are underpinned by 10-year leases signed by OBI, Europe’s biggest DIY retailer. These properties were bought at a 7% net operating income yield.

“The company plans to pursue other offshore investments in established markets to enhance the composition of the portfolio, while spreading its currency and geographic risk. In upgrading the quality of the portfolio, it is on the brink of finalising the sale of the last of the properties considered non-core.

“In the UK, where the economy endured three lockdowns and suffered a record 10% decline, we have accelerated our shift away from traditional retail, that currently accounts for 37% of our total portfolio value (2020 : 54%). This reduction is part due to repurposing spaces but also a reduction in value.

“It is noteworthy, however, that while traditional retail in the UK has been significantly impacted by the much-changed shopping environment that saw footfall in some major cities plummet by as much as 85%, our main subsidiary, Moorgarth, was still able to collect 78% of rent due (before rent concessions) over the full financial year. “

Boutique, established to satisfy the growing need in the market for flexible, fully equipped office space available on shorter lease terms, now has 4 830 workstations across 32 buildings in Greater London. Some of these belong to Moorgarth that buys and equips buildings for Boutique’s use.

“Based on the number of new deals finalised since year-end and the continuing high level of interest in this type of commercial accommodation, we believe the business is well positioned to benefit from the global shift to a more flexible working environment,” Esterhuyse said.

On the outlook for Tradehold, he says: “There’s no denying the havoc the pandemic has wrought but we remain cautiously optimistic about a UK recovery post its large-scale vaccination programme and re-opening of its economy. Given management’s proven responsiveness this past year, we do foresee an improved performance in the new financial year.”

ISSUED BY

Tradehold Ltd.

DATE ISSUED

24 May 2021

MEDIA ENQUIRIES

Friedrich Esterhuyse, joint CEO, Tradehold

021 929 4888