TRADEHOLD BACK IN THE BLACK AND RESTRUCTURING

Tradehold returned to profitability in the year to February 2022. This was despite the continuing impact of Covid-linked restrictions in its key markets of the UK and South Africa, where it also was able to weather the devastation brought on by last July’s KZN riots.

The property group posted a net profit of £20.3m (R419.6m) in strong contrast to the loss of £39.7m reported the previous financial year.

Tradehold reports its results in pounds sterling as most of its subsidiaries conduct their business in that currency. Doing so also eliminates any distortions caused by fluctuations in rand value.

Currently, Tradehold’s assets are split mainly between the UK and South Africa, with smaller investments in Austria and Namibia. In South Africa it owns 74.3% of the Collins Property Group, and in the UK 100% of the Moorgarth Property Group, including a holding of 90% in Boutique, a provider of flexible office accommodation in Greater London and elsewhere.

Total assets amounted to £830m (2021: £808m) while revenue increased from £74.3m to £79.2m. Headline earnings per share improved from -1.9p to 3.9p while tangible net asset value per share rose to 101.3p (R20.96).

In the light of these results, the board has declared a final dividend of 30c per ordinary share to bring the total pay-out for the year to 60c per ordinary share.

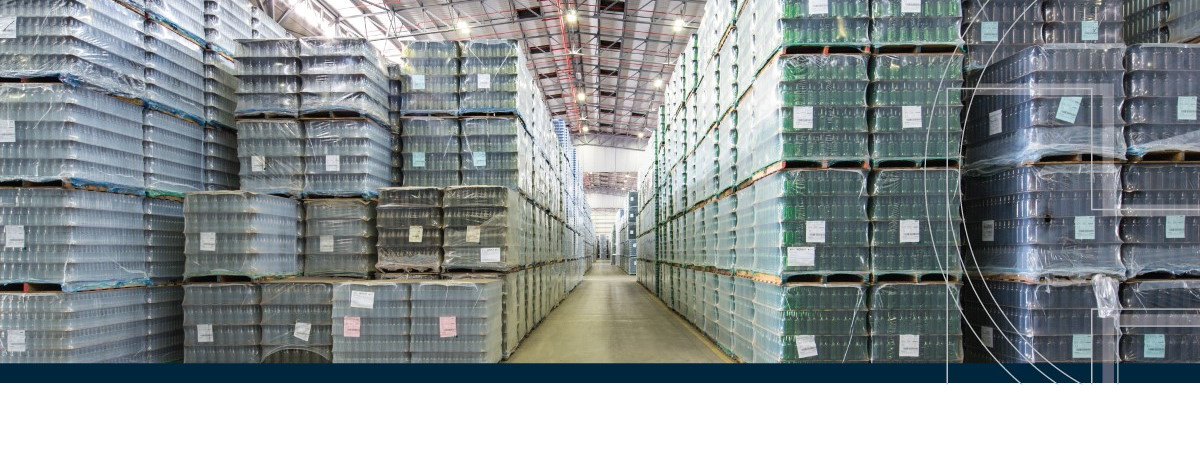

At the same board meeting to approve the 2022 results, the independent directors also agreed to a far-reaching restructuring of the business. This will result in the disposal of Tradehold’s UK interests and the subsequent conversion of Tradehold into an industrial/logistics focussed real estate investment trust (REIT) that reports in ZAR. The UK interests are to be sold for £102.5m to a UK company owned by some of Tradehold directors and main shareholders.

Tradehold joint CEO Friedrich Esterhuyse said the sale would not only enable the company to significantly simplify its present complicated corporate structure but also to dispose of the UK portfolio. “We believe the challenges facing the UK business of high gearing levels and structural changes in retail can better be dealt with in an unlisted environment “

The proceeds from the sale will enable Tradehold to reduce its debt levels by settling an outstanding debt to RMB of £55.6m. The balance of the proceeds from the sale will be distributed to shareholders in the form of a special dividend that, based on current exchange rates, would be R3.50 per Tradehold ordinary share.

The sale of the UK assets will be submitted for approval to the annual general meeting of shareholders on 1 August. Only non-conflicted shareholders will be able to vote.

Collins was the star performer amongst Tradehold’s subsidiaries, contributing £16.7m to group profits while the value of its portfolio at year-end stood at £463m (R9.5bn). It managed to contain vacancies at 2.5% of its gross lettable area of some 1.5m m² while collecting 99% of all income due.

At the end of the financial year the weighted average lease expiry date of its entire portfolio was 5.7 years, buffering it against any short- to medium-term upheavals in the local economy. More than 80% of all debt was hedged directly or indirectly against interest rate movements.

Esterhuyse said he believed converting Tradehold to an industrial/logistics focussed REIT would enhance the attractiveness of Tradehold as an investment opportunity. “In my experience, investors understand and accept REITs that are obliged by law to maintain a relatively low level of debt while at the same time having to pay a high dividend annually. Tradehold will also be a REIT in a sector which has always been a favourite among property investors.”

Although Collins outshone the rest, the UK operations nevertheless did well for themselves. Despite an extremely challenging time for business, especially for the retail sector, Moorgarth was able to achieve a net profit of £4m as against a net loss of £31.1m in 2021, a time of significant property devaluations due to the impact of COVID. It managed to collect more than 90% of all rent due across the portfolio, an achievement above market average.

Boutique, which reported a loss of £679 000, managed to increase occupancy from 67% at the beginning of the year to 85% by year-end. Management believes it finds itself in a good space in a growing market for flexible office accommodation.

Esterhuyse said although the effects of the pandemic were slowly diminishing, new challenges were facing the group’s operations in South Africa as well as the UK.

“Collins, largely focused on KZN, had nine properties affected by the recent devastating floods in that province. Although the damages are still being assessed, Collins is adequately insured against any loss. As far as the UK is concerned, its recovery, as with many countries, is being hampered by inflation as well as continuing trading issues following Brexit and now the war in Ukraine,” Esterhuyse said.

ISSUED BY

Tradehold Ltd.

DATE ISSUED

23 May 2022

MEDIA ENQUIRIES

Friedrich Esterhuyse, joint CEO of Tradehold

021 202 8921