TRADEHOLD’S RESTRUCTURING APPROVED

Tradehold shareholders approved a far-reaching restructuring of the business that also involves the disposal of all the company’s UK interests, at a meeting yesterday (30 August).

These interests are being sold for £102.5m to a British company owned by some of Tradehold’s directors, including its main shareholders. Only non-conflicted shareholders were able to vote on the decision whether to sell the UK interests or not.

After the transaction, Tradehold’s main remaining asset will be South Africa’s Collins Property Group of which it owns 74.3%. In the year to February 2022, Collins contributed 82% to group profits.

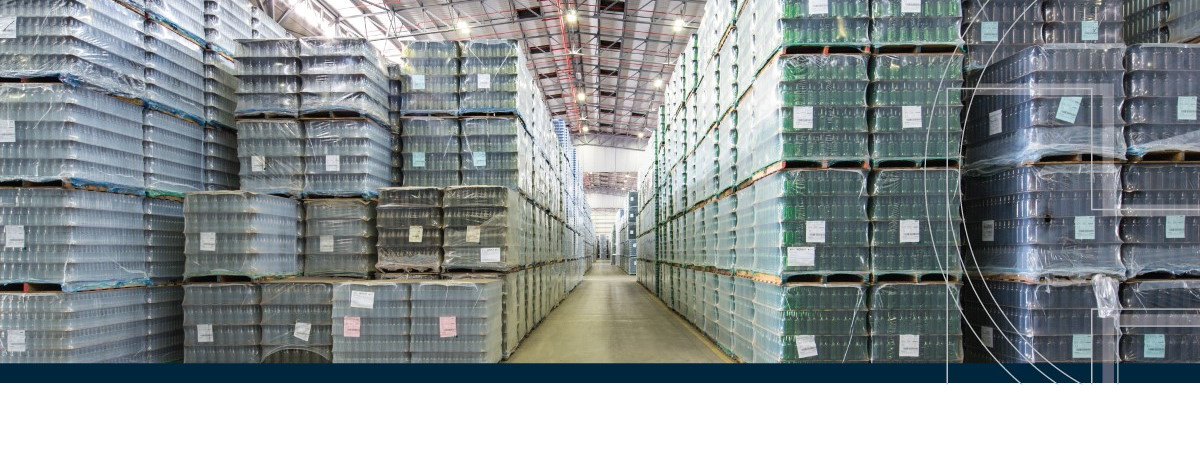

As part of Tradehold’s restructuring (also intended to simplify the structure of the group), its JSE listing will be turned into an industrial/logistics-focussed real estate investment trust (REIT). Unlike in the past, when the company reported its results in pound sterling, it will in future do so in ZAR.

Tradehold CEO Friedrich Esterhuyse said the proceeds from the sale would enable the group to reduce its debt levels. The balance of the proceeds from the sale would form part of a special dividend to be distributed to shareholders that, based on current exchange rates, would be about R4.10 per Tradehold ordinary share.

Esterhuyse said he believed converting Tradehold to an industrial/logistics-focussed REIT would enhance the attractiveness of Tradehold as an investment opportunity, in contrast with when its share price was well below its NAV.

“In my experience, investors understand and accept REITs that are obliged by law to maintain a relatively low level of debt, while also paying a solid annual dividend. Tradehold will also be a REIT in a sector favoured by property investors.”

ISSUED BY

Tradehold Limited

DATE ISSUED

30 August 2022

MEDIA ENQUIRIES

Friedrich Esterhuyse, CEO of Tradehold

friedrich@collinsprop.co.za

021 202 8921