TRADEHOLD ON TRACK AFTER RESTRUCTURING

In the six months to end August Tradehold repositioned itself as a dedicated property business after unbundling its financial services and solar energy business interests to shareholders and listing these separately on the JSE’s AltX as Mettle Investments.

It has 40% of its net property interests in the United Kingdom, 52% in South Africa and Namibia, and the remaining 8% elsewhere in Southern Africa. Pound sterling has been used as Tradehold’s reporting currency since its establishment.

As a result of the restructuring, Tradehold’s financial results for the six months are not directly comparable with the corresponding period in 2017 which included those of the financial services businesses.

During the reporting period tangible net asset value per share, which the board has accepted as the company’s measure of performance, came to 119 pence (R22.73) as against 127 pence (R21,33) in the corresponding period if the unbundled financial services are excluded.

This represents a very substantial discount to the company’s share price which currently trades at about R12.50 a share.

Tradehold joint CEO Friedrich Esterhuyse said during the reporting period, subsidiaries in both its main markets had operated under the most challenging trading conditions. In the UK this was due mainly to Brexit uncertainty and the rise in online shopping, while in South Africa the economy has slipped into a recession with little promise of a sustained recovery in the near future.

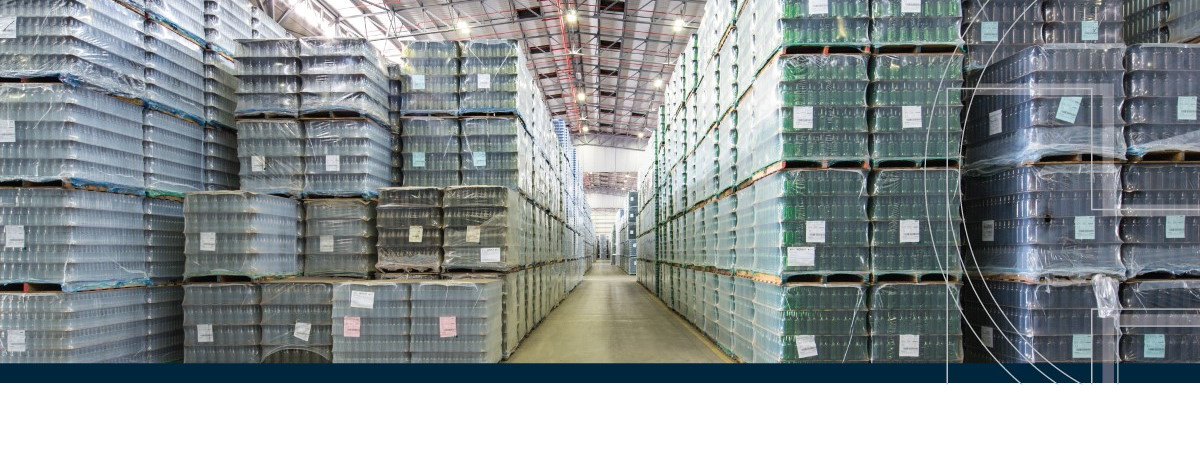

“In South Africa, we are increasing our focus on high-quality industrial warehousing which already represents 91% or 1.46m m² of our total of 1.61m m² gross lettable area. The weighted average lease profile of these properties, which counts companies such as Sasol, Pep, Unilever, MassMart and Nampak among their long-term tenants, is 7.17 years while vacancies have been maintained at 2%.”

To strengthen this focus, Collins Group, the name under which Tradehold operates locally, has started selling off certain non-core assets in its portfolio of 150 properties, these being 37 smaller buildings. At the end of August, the total value of Collins portfolio, including the properties Tradehold owns in Namibia, was £501m (R9,57bn) compared to £576m (R9,4bn) as at 28 February 2018. The Collins Group contributed 63,8 pence (R12,18) to net asset value per share.

In the UK, Moorgarth, Tradehold’s main subsidiary in that country which owns a portfolio of 23 properties diversified across a number of sectors, experienced a tough six months especially in terms of retail and commercial properties lettings. During that time it launched a concerted campaign to change the nature of its four shopping centres that account for just over 50% of the value of its portfolio. This was to accommodate the major shifts currently occurring in consumer buying patterns, online shopping in particular.

“These changes include a strong focus on leisure and convenience, and a return to a traditional trading market model that embraces community-driven retail involving local traders and suppliers and local produce. Also, the tenant mix increasingly reflects a growing range of services and facilities such as restaurants, cinemas, gyms, and even dentists’ and doctors’ rooms.”

Esterhuyse added that the development pipeline on Moorgarth’s portfolio was in excess of £150m. “This will ensure, once planning approval has been granted, a significant reduction in the company’s reliance on conventional retail.”

Moorgarth contributed 48.2 pence (R9.20) to net asset value per share.

The Boutique Workplace Company (TBWC) which offers serviced office accommodation in 30 sites across London experienced intense competition, during the reporting period. This was mainly from new entrants aggressively building market share at the expense of profitability. Although it lost some tenants in the process, management was confident that TBWC’s quality offering would gain increasing acceptance from a discerning market.

ISSUED BY Tradehold Ltd.

DATE ISSUED

8 November 2018

MEDIA ENQUIRIES

Friedrich Esterhuyse, joint CEO, Tradehold

021 928 4800