TRADEHOLD SETTLES ACQUISITION OF COLLINS GROUP'S R7.8bn SOUTH AFRICAN PORTFOLIO

20 February 2017 – Johannesburg, South Africa - Listed property company Tradehold (JSE:TDH) has completed its acquisition of the Collins Group, with the purchase of the Collins Group’s South African property portfolio, as well as its property development and management business.

The purchase price of R1.7 billion was settled with R38.2 million in cash and through the issue of 57.7 million new Tradehold shares at R28.73 per share, with the final tranche of 47.2 million shares at a value of R1.35 billion being issued today. The transaction is accretive from a net asset value per share perspective.

Tradehold announced its intention to purchase the Collins Group’s South African assets and its property development and management business in June 2016. All conditions precedent were met in December 2016.

This final element of Tradehold’s purchase of the Collins Group follows Tradehold’s acquisition of the Collins Group’s United Kingdom and African portfolios in a £28.2m deal concluded in March 2015.

The Collins Group will now operate as a wholly owned subsidiary of Tradehold, which also owns United Kingdom portfolios Moorgath, Reward Finance Group and The Boutique Workplace. Other subsidiaries include South African based Mettle, Namibian based Nguni Property Fund and Tradehold Africa with assets in Botswana, Zambia and Mozambique.

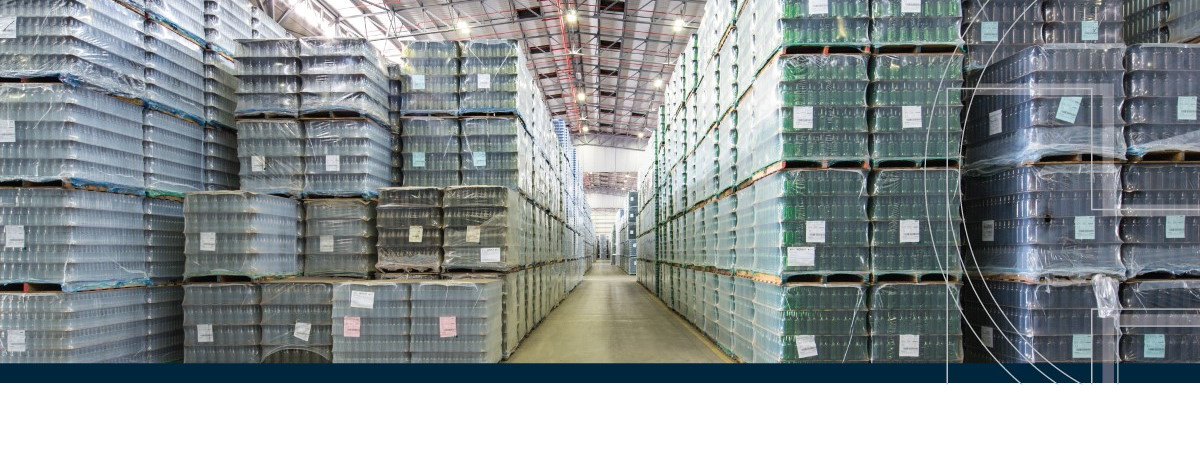

Valued at R7.8 billion, with a net asset value of R1.7 billion, The Collins Group’s diversified South African portfolio consists of 151 commercial, industrial and retail property assets with a combined gross lettable area (GLA) of 1,6 million square metres, with 346 tenants. Industrial buildings make up 75 percent of the portfolio, with 16 percent being distribution centres. Its tenant profile by GLA is 81% national tenants, while the vacancy rate is a low 1.8% of GLA.

“We are delighted to have gained access to the expertise and experience of the Collins Group’s senior management whose in-depth knowledge of the property industry is not restricted to South Africa, but takes in much of Africa and the United Kingdom,” says Tradehold chairman Christo Wiese. “Welcoming the highly experienced senior staff of the fourth-generation, family-owned Collins Group will ensure continuity locally and abroad, as we continue to grow the Tradehold portfolio.”

Tradehold has had significant success in its approach to purchasing properties, improving them, and then either retain them as part of the core portfolio or selling them for profit after adding value. Its understanding of different property classes in different areas of South Africa and the United Kingdom has seen its acquisitions achieve positive value – whether they are a small office building in central London, a shopping centre in Bolton in greater Manchester, or a distribution centre in Gauteng.

Kenneth Collins, director of the Collins Group, joins the Tradehold Board after the transaction. “The Tradehold approach of adding value to its properties through its roles as property developer and active property manager harmonise with the Collins Group’s foundations in the property industry, going four generations back,” he says.

“It’s a big step for a family-owned business to become part of a bigger, listed company, but our respective cultures, philosophies and ways of doing business are very complementary,” says Friedrich Esterhuyse, joint CEO of the Tradehold Group. “Together, we will build on Tradehold’s entrepreneurial approach, and look at opportunities in various markets to growth NAV per share.”

ENDS

About Tradehold

JSE-listed Tradehold is an investment holding company with a focus on commercial and industrial property-related investments in the United Kingdom, South Africa, Namibia, Botswana, Zambia and Mozambique. Its long-term strategy is to build shareholder value through sustainable growth in net asset value per ordinary share issued to shareholders.

www.tradehold.co.za

Contact:

Hema Ghela – Tribeca Public Relations

072 236 5378