TRADEHOLD WEATHERS BREXIT FALL-OUT

Tradehold’s Moorgarth Property Group in the UK has weathered the Brexit fall-out extremely well in the six months to end August 2016, according to Tradehold chairman Christo Wiese. Focused primarily on commercial and retail property, Moorgarth has increased revenue by 104.5% to £13.9m and its contribution to Tradehold’s net profit by 220% to £6.4m.

The company reports its results in pound sterling as most of its subsidiaries conduct their business in that currency.

Tradehold, with property interests located in the UK and southern Africa, maintained its robust growth momentum of the past two years both in terms of profit and assets. Revenue for the period increased 71% by £20.9m, while the total profit attributable to shareholders was 39% higher at £10.9m.

Total assets grew by 26% to £379m (2015: £300m) and total profits attributable to shareholders by 39% to £10.9m. Core headline earnings, which exclude once-off and non-operating items, increased by 84% to 5.7 pence a share. Net asset value per share grew 11.7% to 92.6 pence. Wiese said Tradehold was adopting net asset value as the measure for future trading statements as the board believed it was a more relevant measure for a predominantly property business.

Joint CEO Tim Vaughan who also heads up Moorgarth, said the refurbishment of the company’s two main shopping centre complexes, the one in the Manchester area, the other at Reading outside London, were on track. In the case of both, lettings and revenue were markedly up on the corresponding reporting period while Moorgarth’s acquisition in December 2015 of Ventia Ltd had “elevated its serviced-office division with over 3 000 work stations to one of the foremost in central London”.

Reward, Tradehold’s financial services arm in the UK, also achieved solid results during the reporting period, contributing £1.9m to the net profit of the group.

In southern Africa, the group’s focus continued to be on consolidating its operations in Namibia and Mozambique, as well as working to achieve economies of scale in those countries. In Namibia, Tradehold Africa is presently involved in 11 substantial properties in various stages of planning and construction while in Mozambique it has completed the large, purpose-built Acacia Estate in Maputo with units leased on a long-term basis to the US Embassy in Mozambique and to the American oil-exploration company Anadarko.

Looking ahead, Wiese said in the light of market volatility following Britain’s decision to withdraw from the European Union, Tradehold remained careful in the acquisition of new assets there while rigorously managing those already in its portfolio. He expected Tradehold’s results for the 12 months to February 2017 to exceed those of the previous financial year.

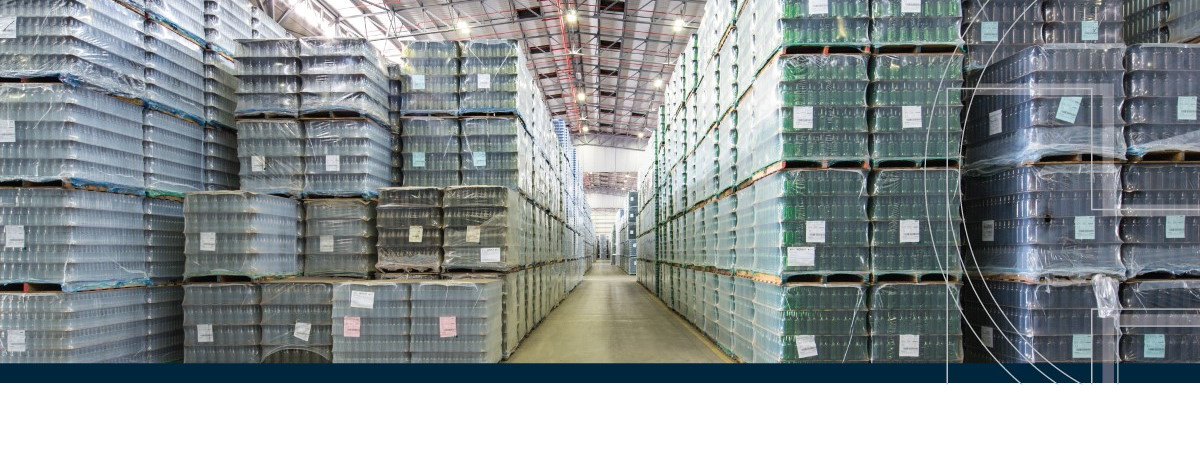

Joint CEO Friedrich Esterhuyse who is based in Cape Town, said Tradehold had entered into an agreement with the Collins Group of KwaZulu-Natal in terms of which Tradehold will acquire, pending shareholders’ approval, the commercial property business of the latter for R1,715bn . The acquisition includes a portfolio of 151 mainly industrial properties in South Africa and an in-house property management business. The purchase price is to be settled mainly by means of new Tradehold shares and the transaction is expected to be completed during December 2016.

Ends

ISSUED BY Tradehold Ltd

DATE ISSUED 24 November 2016

MEDIA ENQUIRIES

Friedrich Esterhuyse, joint CEO, Tradehold 021 928 4800