TRADEHOLD REPORTS STRONG INCOME BOOST FOR 2018

Tradehold’s revenue for the year to February 2018 more than doubled to £101 million from £43.5 million. This followed the acquisition of South Africa’s Collins Group whose results were integrated for the full reporting period for the first time. As most of the company’s subsidiaries conduct their business in pound sterling, and to avoid the distortion caused by the fluctuating value of the rand, Tradehold continues to report its results in British currency.

It increased total assets by 7.8% to £1 075 million while the directors’ sum-of-the-parts (SOTP) valuation per share at year-end was 152.9 pence or R25, as opposed to its share price of R16 at the time.

Headline earnings per share rose 300% to 9.2 pence and the company declared a dividend for the year of 50 cents per ordinary share (2017: 10 cents) with a new-share subscription and re-investment alternative.

Tradehold joint CEO Friedrich Esterhuyse said crucial decisions were taken during the year that have materially impacted the positioning of the company. The unbundling of its financial services division from the property assets will be completed on 28 May when it will be listed separately under the name Mettle Investments.

“We have thus created two separate, focused businesses each with its own clear identity. The simplified group structure should make it easier for investors to evaluate the potential of the two entities and hopefully help narrow the discount between the SOTP and the share price.”

Tradehold is also disposing of the bulk of its non-South African assets elsewhere on the continent given the complexity of managing a small number of properties spread over several countries. The exception, however, is Namibia, a major area of investment for Tradehold. It has nevertheless decided not to pursue its previously announced intention of listing these assets on the Namibian Stock Exchange but are instead integrating them more closely with those of Collins Group.

“The result of all these changes is that in the case of the property company, management can now focus fully on its two main areas of investment – South Africa and the UK – while the team at Mettle Investments will go in search of growth, both organically and through acquisition."

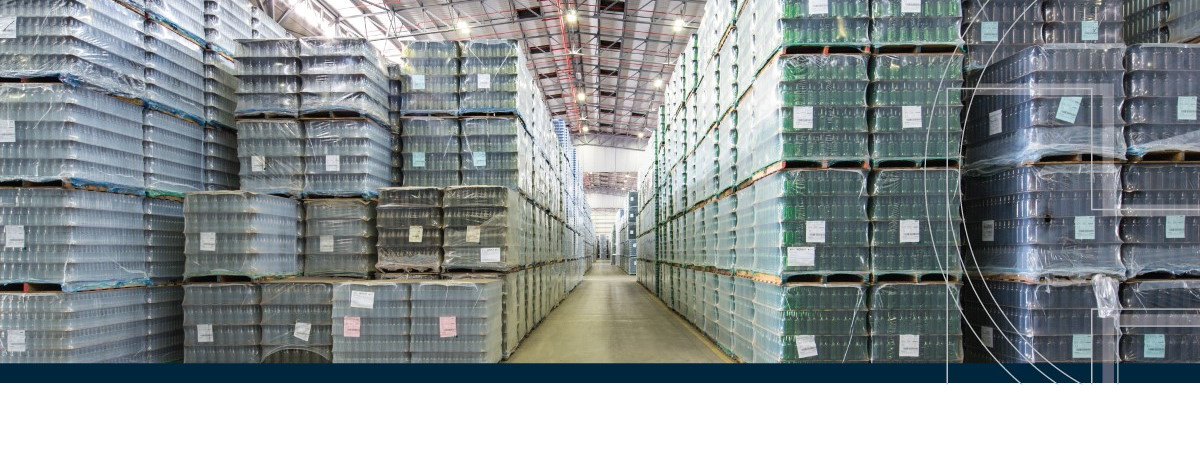

Esterhuyse said in the light of the changed environment in South Africa, he was very positive about the growth potential of Collins Group. “Its main focus is on industrial property, which constitutes 91% of the total portfolio of 144 properties. These include a number of large, state-of-the-art distribution centres which have some of the country’s foremost corporates as long-term tenants. At year-end, occupancy of the total portfolio was 98.4% while the weighted average lease expiry profile is 7.7 years.

“We believe Collins is excellently placed to benefit from any increase in demand for industrial space should economic growth in the country continue to advance.”

Esterhuyse said conditions in the UK market were obviously challenging with everyone awaiting the outcome of Brexit. “However, change also creates opportunities. Moorgarth, our wholly-owned subsidiary in the UK, was able to time its entry into the area of serviced office space very well, as this is an area experiencing increasing demand given the prevailing business environment volatility and the reluctance of some companies to commit to long-term lease agreements.

“Moorgarth is also in the process of changing its four major shopping malls into destination centres where people not only shop, but also spend their leisure time at the malls’ restaurants, cinemas as well as entertainment and play areas. In one of these updated centres, tenants’ gross turnover increased by 21% over the year and footfall by more than 15% against the national average of -2,5%”.

Esterhuyse said management’s focus in the new financial year will be to unlock the full potential of its various businesses and to continue adding value to the new assets acquired.

ISSUED BY Tradehold Ltd

DATE ISSUED

24 May 2018

MEDIA ENQUIRIES

Friedrich Esterhuyse, joint CEO, Tradehold

021 928 4800